Technical Analysis: Week 19, 2025

(DAX 40 | Dow Jones | USD/CAD)

Welcome to your weekly edge in the markets, brought to you by WeTrade in collaboration with Trading Writers.

This report is designed to give you clear, actionable insights each week. It’s split into two parts:

1. Weekly thoughts – practical trading strategies, tips, and educational ideas to help sharpen your skills.

2. Setups & signals – our top 3 trade ideas for the week, complete with charts and key levels to watch.

Weekly Thoughts

You’re watching the 100m sprint in the Olympics. There are two runners and one’s clearly pulling ahead. Do you back the leader to claim the gold or bet the slower one suddenly finds speed out of nowhere?

The idea is quite simple - bet on winners!

The idea behind the title of this week’s newsletter that "catch-up trades rarely work" comes from the principle that markets showing strength tend to stay strong, while weak ones stay weak.

Here's the core of the concept:

Strong markets attract capital. Momentum and relative strength often persist because traders chase performance and flows reinforce the trend.

Weak markets are weak for a reason. Unless something changes fundamentally or technically (e.g. relative strength improves), there's no edge in assuming they'll "catch up."

Buying the laggard is betting on mean reversion without a catalyst. That can work, but only when there’s actual evidence of a shift—namely improving relative strength, or a fundamental narrative.

Momentum often trumps valuation. Just because something hasn’t moved yet doesn’t mean it will. More often, what’s already moving continues to move.

In short: strong markets often get stronger, and buying the laggard just because it's lagging is usually a low-probability play—unless the relative strength picture starts to change.

A prime example from 2025 is gold vs silver.

As gold steadily climbed to record highs throughout early 2025, many traders assumed silver would catch up. After all, the two often move together, and silver looked “cheap” in comparison. But that’s exactly the catch-up trap.

Here’s what actually happened:

- Gold showed clear relative strength, supported by strong buying flows and macro narratives (rate cuts, geopolitical risks, etc.).

- Silver lagged, and never confirmed the same bullish momentum. Every rally attempt was short-lived.

The gold/silver ratio (which measures how many ounces of silver you need to buy one ounce of gold) kept rising, a clear signal that gold was outperforming and maintaining leadership.

So while silver looked like a bargain, gold was the better trade.

A great live example this week is DAX 40 vs the Dow Jones Industrial Average (DJIA).

The DAX just hit a record high, shrugging off concerns and showing strong momentum.

Meanwhile, the DJIA has only retraced around 61.8% of its March–April decline, which was triggered by Trump’s so-called tariff ‘Liberation Day’.

This sets up a classic "catch-up trade" temptation:

Sell the DAX on a potential double top and buy the Dow in hopes it rallies to test its old highs.

But here’s the issue:

- The DAX has relative strength. It’s the market attracting capital, making new highs, and leading global equities.

- The DJIA is still recovering, showing hesitation and underperformance in comparison.

Unless something shifts, betting on a catch-up is the lower-probability trade.

A better approach might actually be the opposite:

Stick with the DAX’s strength. If anything, sell the Dow if it stalls again near the 61.8% retracement level as a hedge (like we discussed last week).

Setups & Signals

We look at hundreds of charts each week and present you with three of our favourite setups and signals.

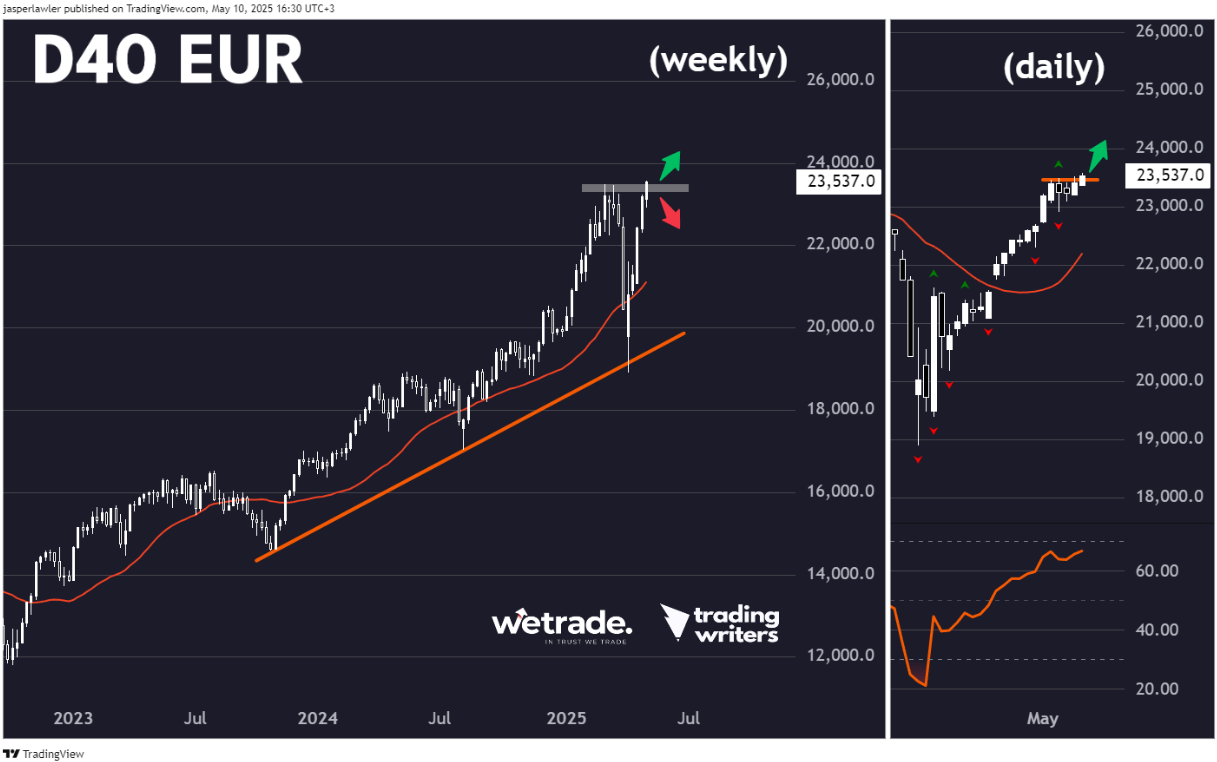

DAX 40 (D40/EUR)

Setup

The DAX 40 (traded as D40/EUR with WeTrade) just closed at an all-time high this week. Should next week close back under the prior highs then a Double Top pattern could be in play. However, the rising long term trendline and price above the rising 30-week moving average indicate a well established uptrend, favouring long positions.

Signal

The daily chart shows a strong uptrend with a fresh break to new highs, signalling another leg higher. RSI is not yet technically overbought over the 70 level but could soon be - making future breakouts more likely to fail.

Dow Jones (U30/USD)

Setup

The Dow Jones (traded as U30/USD with WeTrade) has just run into a confluence of the broken neckline of the double top as well as the 61.8% Fibonacci retracement of the March-April decline. The price also remains below the 30-week moving average, favouring short positions.

Signal

The daily chart is trendline higher with positive momentum over the 50 level in RSI. A break below the last fractal low as well as the 20-day moving average would help confirm the weekly resistance level has held and that a new bearish leg lower could be unfolding. A break back over the resistance invalidates the idea.

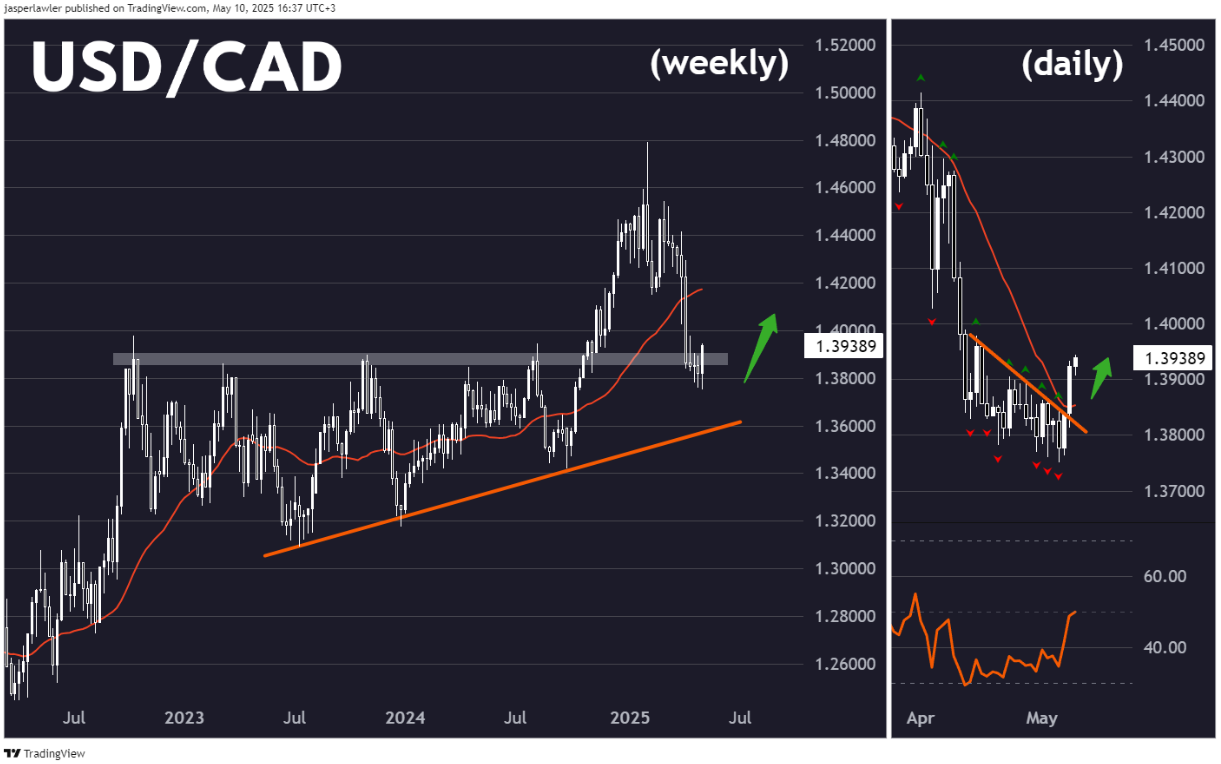

USD/CAD

Setup

The recent trend in USD/CAD has been lower but the bullish engulfing candlestick pattern on the weekly chart around previous resistance-turned support indicates a possible reversal.

Signal

After showing bullish divergence off the lows in RSI, USD/CAD broke above a downtrend line last week on the daily chart, taking price back over the 20-day moving average. A drop below the broken trendline would invalidate the trade.

But - as always - that’s just how the team and I are seeing things, what do you think?

Share your ideas with us - OR - send us a request!

Trade with WeTrade!

Every position closed is one step closer to unlocking WeTrade Honours privileges and redeeming exclusive rewards.

Start your trading journey here - Register now

Kickstart your trading of the week here - Login Now