Technical Analysis: Week 26, 2025

(USD/CHF | AUD/USD | BTC/USD)

Welcome to your weekly edge in the markets, brought to you by WeTrade in collaboration with Trading Writers.

This report is designed to give you clear, actionable insights each week. It’s split into two parts:

1. Weekly thoughts – practical trading strategies, tips, and educational ideas to help sharpen your skills.

2. Setups & signals – our top 3 trade ideas for the week, complete with charts and key levels to watch.

Weekly Thoughts

This week the Swiss franc strengthened to around 0.80 per US dollar, its highest level since July 2011. For forex traders that shows up as USD/CHF hitting a near 14-year low.

Clearly more buyers than sellers of the Swiss franc! But why?

The Swiss franc is a known safe haven - meaning it usually appreciates in times of uncertainty. The same can be said of the US dollar, except the dollar is not behaving that way now.

What’s especially interesting about this surge in the franc is that the Swiss National Bank just cut Swiss interest rates to zero. Yes, a return to ZIRP (zero interest rate policy). In contrast, the US Federal Reserve just left interest rates unchanged at 4.25% to 4.5%.

As you’re probably aware, the currency with the higher interest rate should be the stronger one (in this case, the US dollar). Again it’s not happening.

In short - the Swiss franc is gaining on lower interest rates and the US dollar is falling on stable & much higher rates.

There are, of course, other factors at play. There are rising expectations of Federal Reserve rate cuts, possibly as soon as September. Not to mention economic uncertainty over upcoming trade deadlines linked to President Trump’s tariff policies.

There is also Speculation that Trump could replace current Fed Chair Jerome Powell and nominate a new dovish Chair as early as September or October - which has added to concerns over the central bank’s independence.

What next for CHF?

As traders, what are the key points here? To us - 3 things

1. New multi-decade highs are bullish (reasons to buy, not sell!)

2. The Swiss franc is strengthening despite central bank policy that should weaken it

3. The US dollar keeps trending lower

Piecing that all together, we’re looking at a breakout to multi-year highs in the franc, backed up by breakdowns in the dollar across several pairs (e.g. AUD/USD & BTC/USD), which is in the direction of the established dollar downtrend.

Of course, there is always the possibility of more false breaks - this time a false breakdown in the dollar instead of the false USD breakouts. As always, we must manage our risk.

Overall, we’re looking into buying the CHF strength, selling the USD weakness when the opportunities present themselves.

Setups & Signals

We look at hundreds of charts each week and present you with three of our favourite setups and signals.

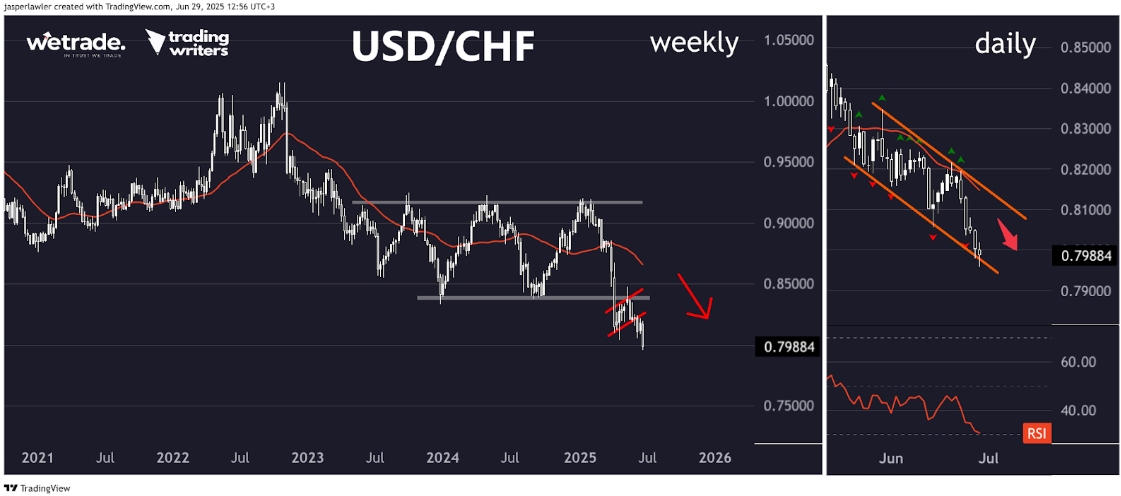

USD/CHF

Setup

The pair looks to have broken down from a bear flag pattern, confirming an earlier breakdown to decade-lows this year after holding resistance at 0.84.

Signal

On the daily chart, there is an established downward channel, where rebounds to the top of the channel (also, 20 SMA) could offer short opportunities in line with the longer term downtrend.

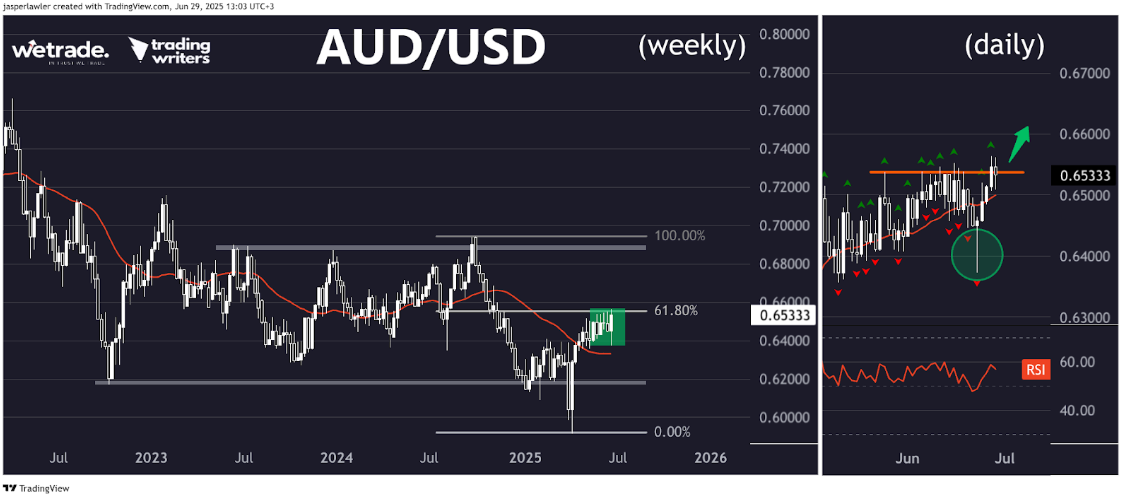

AUD/USD

Setup

The Aussie dollar pair has just made a strong weekly bullish engulfing pattern that engulfs the prior 5 weeks right into major resistance caused by the 61.8% Fibonacci retracement.

Signal

A false breakdown below 0.64 triggered a hammer reversal on the daily chart, which eventually triggered a breakout of the prior highs just above 0.65. While over 0.65 we’s expect a continuation move higher.

Bitcoin

Setup

After a false breakdown below $100K, Bitcoin just made a bullish engulfing pattern that engulfed the prior 3 weeks - possibly forewarning of a breakout to a new ATH.

Signal

The false break below $100k is more clearly seen on the daily chart with a follow-through surge over $108K to re-test down-sloping resistance through the previous two peaks.

But - as always - that’s just how the team and I are seeing things, what do you think?

Share your ideas with us OR send us a request!

Trade with WeTrade!

Every position closed is one step closer to unlocking WeTrade Honours privileges and redeeming exclusive rewards.

Start your trading journey here - Register now

Kickstart your trading of the week here - Login Now