One thing I’ve learned over the years is that a trend always takes longer than you’d expect to get started and also takes longer than you’d imagine possible to end.

Lots of times what looks like a trend reversal is just another correction before the trend resumes.

That’s why it doesn’t make sense to trade every trend reversal you see.

But how can you tell the real vs fake reversals?

The sad truth is there is no perfect answer - but after years of forward and backward testing the markets - by far the most effective strategy we’ve found is multi-timeframe analysis.

And there is an example playing out right now in EUR/USD

EUR/USD

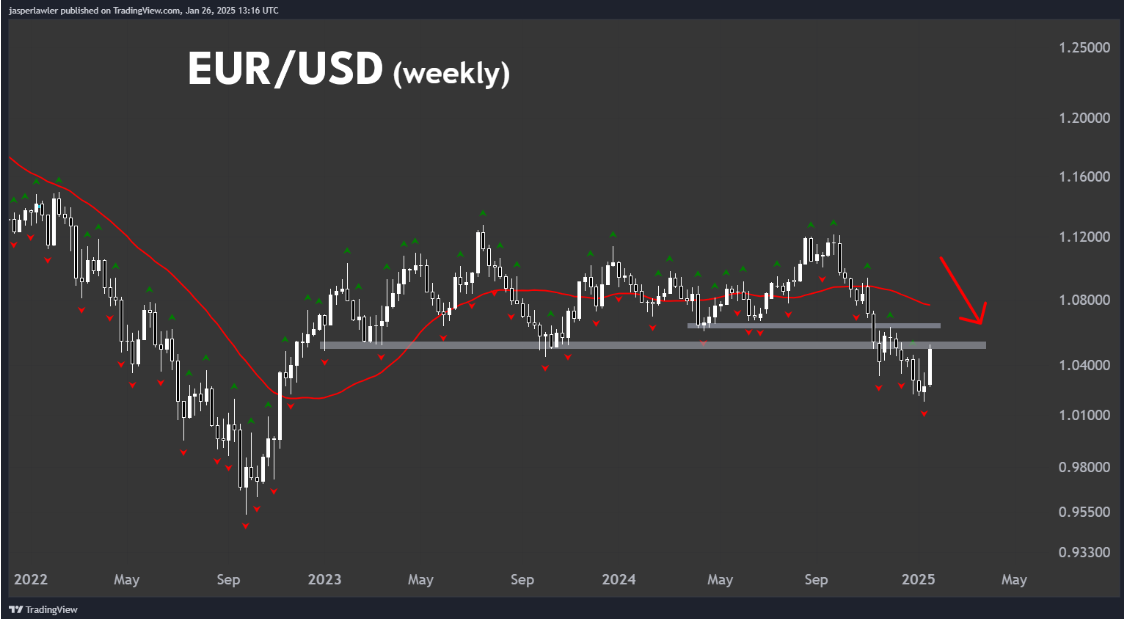

The weekly chart shows EUR/USD in a strong corrective move upwards in what is otherwise a bearish environment with the price well under a moderately downward-sloping 30-week moving average.

The corrective move has banged straight into former support-turned-resistance around the 1.05 level. This level could break given the strong upwards momentum last week but there is also a good chance that it holds.

Should 1.05 break, there is the next layer of resistance above between 1.06 and 1.0650.

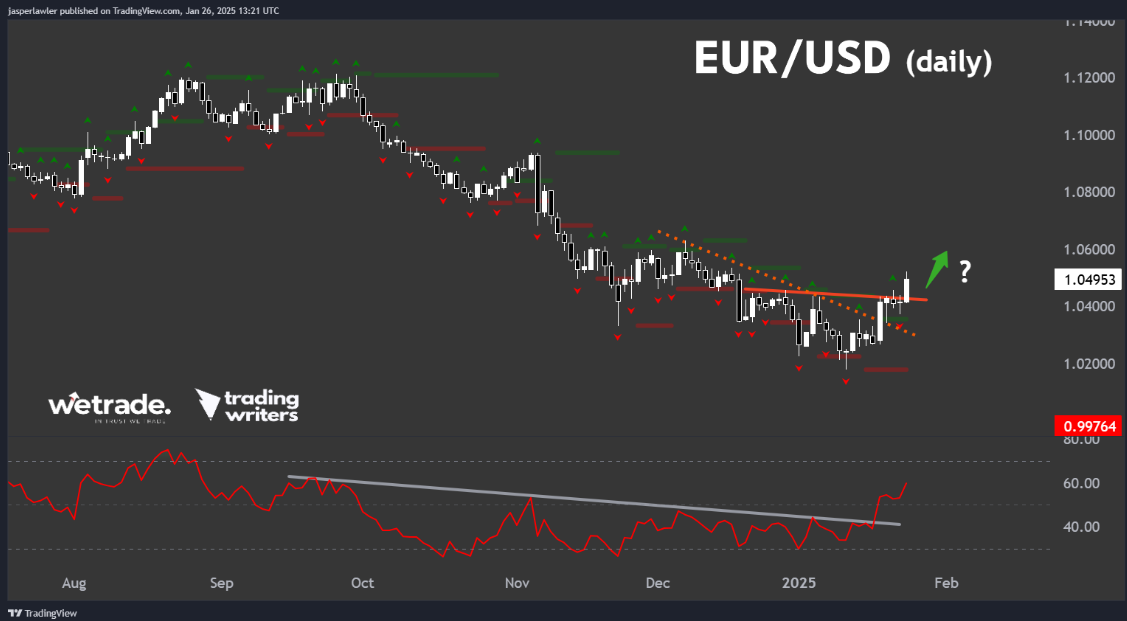

Now looking at the daily chart we see a nice bullish trend reversal taking shape.

But the question again is - should we trade with this breakout?

It could absolutely work out. This is the second trendline break, which is this time supported by the break in the RSI trendline - and the long downtrend in EUR/USD is overdue for a correction.

But with all that resistance in the way, we think this particular trend reversal just does not show the kind high-conviction setup we like to see.

Again, we could be wrong and EUR/USD shoots up from here - but just in case we are right, we’re watching for failures at the aforementioned resistance levels.

Nikkei 225 (225/JPY)

Last week we mentioned the new record high in the FTSE 100 index (100/GBP).

In week 2, we talked about the S&P 500 (SPX/USD) and how we would not trade the bearish setup and wait for a bullish breakout above the triangle - which just happened this week.

Before that we mentioned the breakout of the DAX (D40/EUR) back in week 49 when the price was at 19,650 - it closed last week at 21,400.

Now we have two more indices we think have very good upside potential.

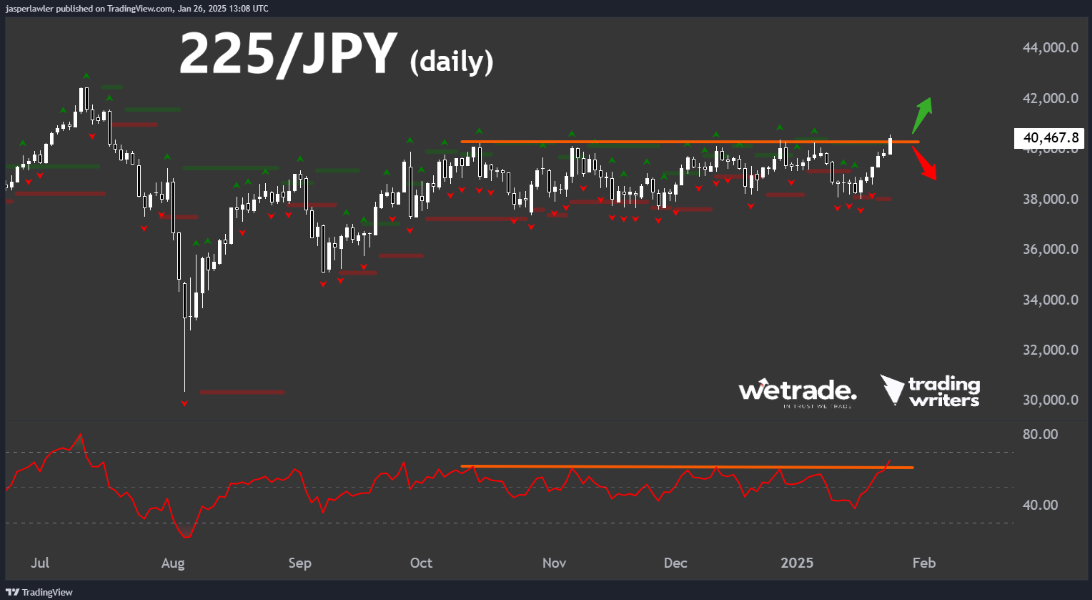

The Nikkei 225 (traded as 225/JPY on the WeTrade platform) is breaking out of a circa 18-week consolidation and has closed the week above the big 40,000 psychological level.

This breakout can be seen more clearly on the daily chart.

If the break holds - we think there is a strong probability that the multi-decade high set in July also breaks, unleashing what could be another huge new leg in the multi-year uptrend.

However, should this breakout fail, the risk is well defined since a move back under the resistance at 40,400 means the trade is no longer on.

Hang Seng (H33/HKD)

Hong Kong’s benchmark index the Hang Seng is a perfect example of how long a trend can take to reverse.

How many times would traders have tried to go long this index only to see it slump right back towards the bottom?

Now while this trend reversal might be delayed further - and might fail altogether - we think there is enough evidence to suggest a reversal is happening.

1. The price is above a rising weekly 30 week SMA

2. A long term trendline has broken

3. Crucially - the price made a double bottom pattern around 15,000

On the daily chart we see the strong surge in buying interest from September has given way to a long multi-month correction.

We are looking for a breakout above the down trendline to demonstrate the correction has finished and a new up-leg is beginning.

The final confirmation would come from a break of resistance (not drawn) from the November and December highs at 21,350.

Should the price turn lower and make a new fractal low under 19,650 then we’ll have to wait a bit longer for the Hang Seng trend reversal.

But - as always - that’s just how the team and I are seeing things, what do you think?

Share your ideas with us - OR - send us a request!

Send us an email or message us on social media.

Trade with WeTrade!

Every position closed is one step closer to unlocking WeTrade Honours privileges and redeeming exclusive rewards.

Start your trading journey here - Register now

Kickstart your trading of the week here - Login Now

Produced by Jasper and the Trading Writers team in collaboration with WeTrade