AUD/USD

Thank you, China.

News of a massive economic stimulus ‘bazooka’ has catalysed a breakout of a long-term triangle for the Aussie dollar that we discussed back in week 34 of this newsletter.

In short, Australia is a big exporter of natural resources and China is its main customer. Governments build roads and bridges - and for that you need resources.

Ultimately, we don’t care what caused the price to go up!

We just know it’s going up and we like it.

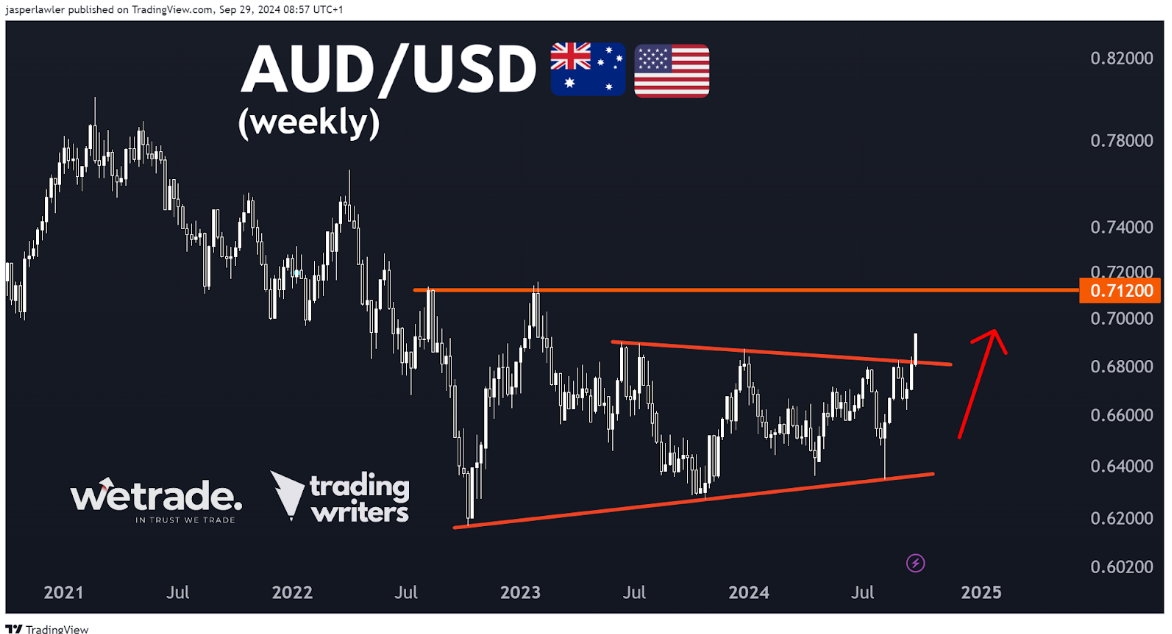

Below you can see the clear-cut breakout on the weekly chart for AUD/USD.

This tells us that while the price is above 0.68 we want to be on the long side of AUD/USD.

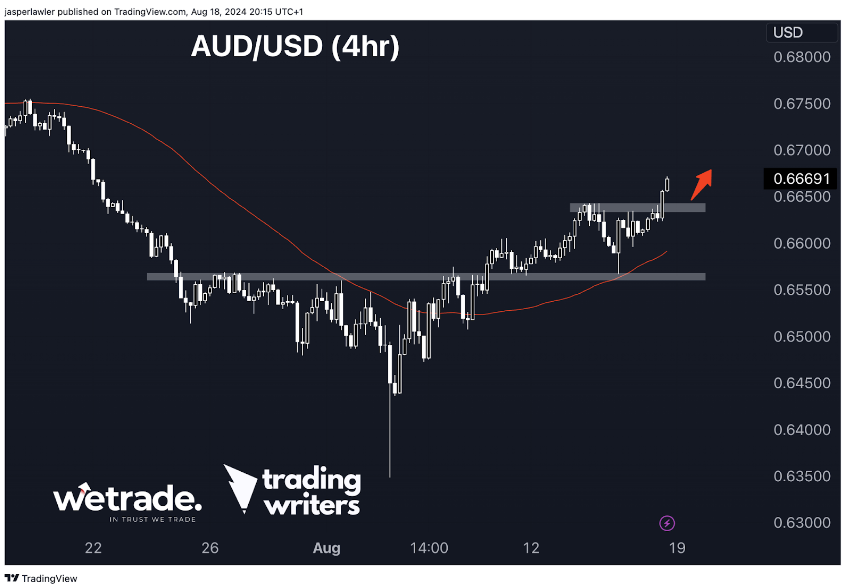

Check out our earlier participation in this ride higher.

From week 34

Dropping down to the daily chart we see this as a really clear breakout from a sideways range.

As always, maybe we’re wrong and this turns into a fakeout - for now, this chart is bullish.

The weekly chart gives us solid resistance just above 0.7100, which roughly coincides with the 161.8% Fibonacci extension of the last decline. Above there the 200% extension is 0.7250.

EUR/USD

The euro is one place where the dollar breakdown has been less pronounced.

The price has been hovering beneath the 1.12 level, which (by no coincidence) is the 61.8% Fibonacci retracement level of the 2021-2022 decline.

From an Intermarket perspective, if all the other major FX pairs are breaking out - the euro should too. That’s because the primary force here is the weak dollar. It’s just that the euro is weak too.

Our base case is that the dollar downtrend continues, and EUR/USD breaks above 1.12.

However, from the perspective of hedging. If you are long other FX pairs, EUR/USD would probably be the one to take in the other direction - i.e. as a hedge - while the breakout is unconfirmed below 1.12.

On the daily chart, we can see how the base was put in, curving down to and up again from 1.0600.

There has been a break and re-test of 1.10, now it's a question of breaking over 1.12. It’s entirely possible we see another drop to 1.10 before the breakout happens. This is where the hedge trade could work nicely.

The weekly chart gives us a 1.17 as a possible upside target from the 78.2% Fibonacci retracement. Before there 1.15 comes in as a round number resistance. A drop below 1.10 would nullify the whole upside breakout scenario.

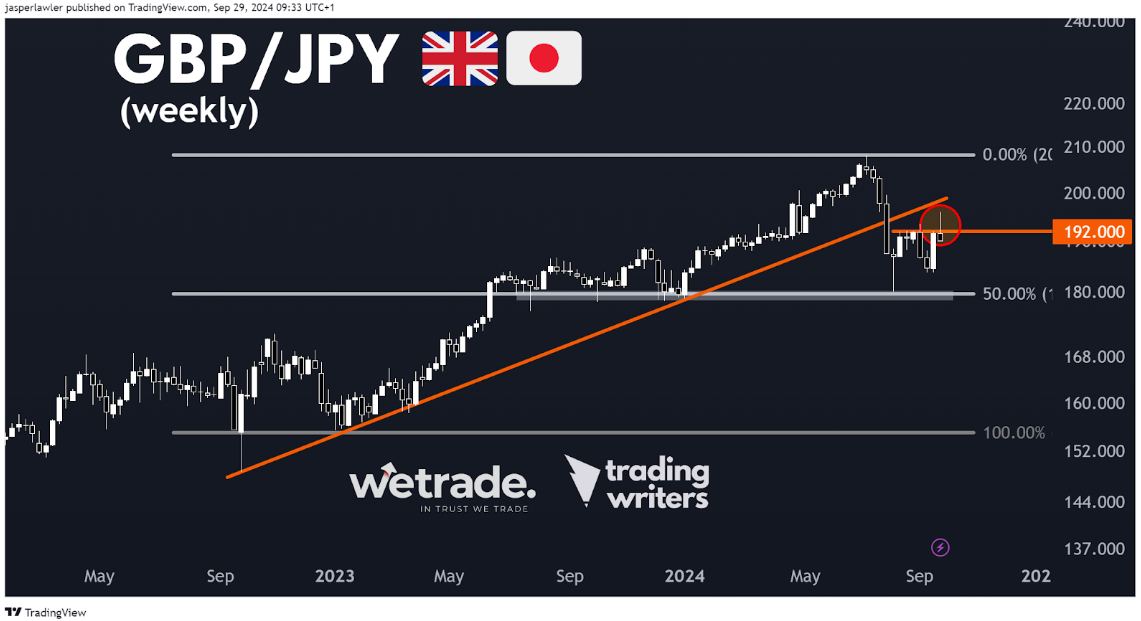

GBP/JPY

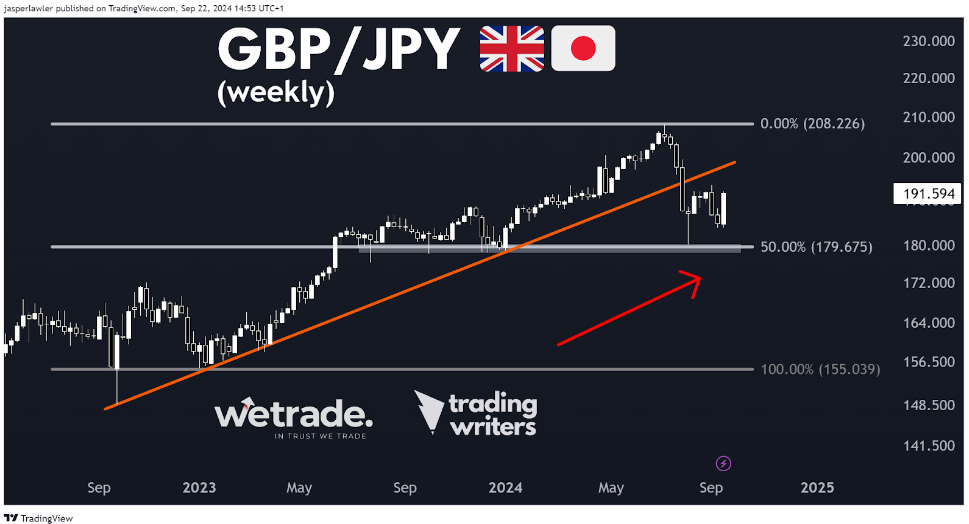

We’re returning to the British pound / Japanese yen cross for another lesson in patience and ‘staying alive to the opportunities’.

We said last week (39) that

The bigger picture for GBP/JPY isn’t too clear - while the long-term trend has been up, the break of the rising trendline would suggest the uptrend has finished.

In the short term, we’re inclined to look for a classic reversal of a 5-week rally at resistance.

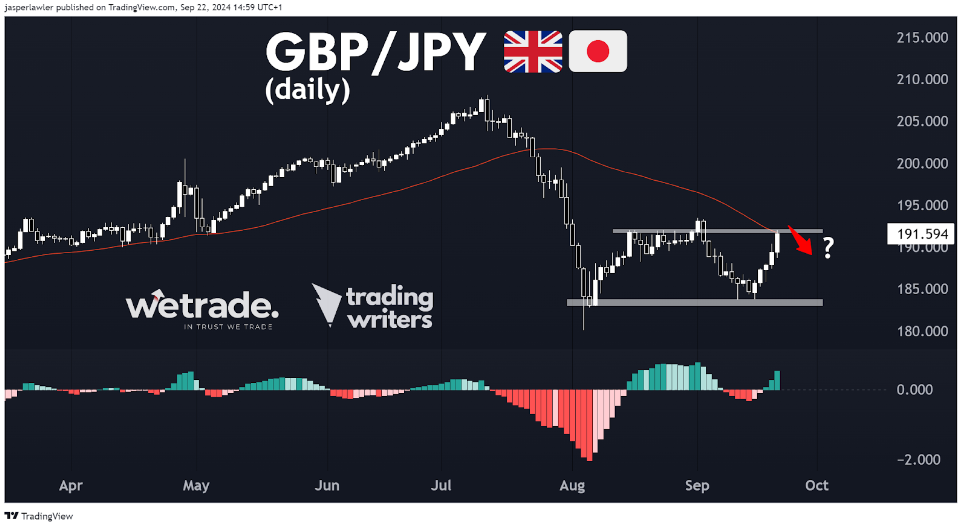

Should the price break above, but then close the day below 192, it would imply a drop further back towards the 187-188 area, if not back to the low at 184.

Well, check out what happened on the weekly chart - a long wick that shows the price rally over 192, only for sellers to come in and see the price close the week below 192.

Followers of the Smart Money Trading (SMT) strategy would call this a ‘liquidity grab’. This is where the ‘smart money’ manipulates the price higher to trigger breakout buy trades and then uses that liquidity to enter big sell orders.

Yes, it’s a big bad market out there - there are people who want to eat your lunch!

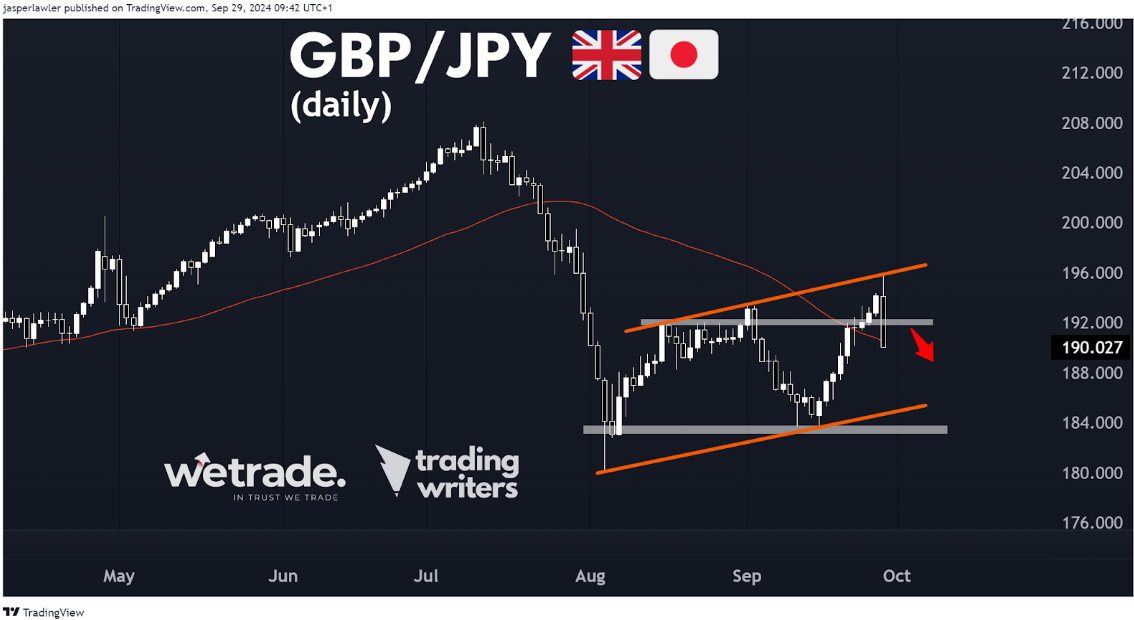

On the daily chart, it’s starting to look like a bear flag pattern. This would suggest a long-term continuation move lower in GBP/JPY.

Short positions at the bottom of this large daily bearish engulfing candlestick pattern offer poor risk: reward.

192 - the same level that triggered the ‘liquidity grab’ is resistance with 186 at the bottom of the bear flag and 184 as the previous swing in September.

But that’s just what we think, do you agree or disagree?

Send us a message and let us know

Happy Trading!

Trade with WeTrade!

Every position closed is one step closer to unlocking WeTrade Honours privileges and redeeming exclusive rewards.

Start your trading journey here - Register now

Kickstart your trading of the week here - Login Now

Produced by Jasper and the Trading Writers team in collaboration with WeTrade.