Gold (XAU/USD)

Gold closing out the week with a new all-time-high (ATH) and with a weekly close over $2500 per oz for the first time is a massive deal.

Of course, the price can and does fall from all-time highs but the important thing is the context. This is indeed what happened in April. The price formed a weekly shooting star reversal pattern and consolidated under that all-time high for 3 months. That decline from an all-time high happened after a monster 2-month rally.

This all-time high has happened after that 3 month consolidation so the price is no longer overbought. Do you see the difference ??

If this breakout is for real, then we should be at the beginning of the next rally in the ongoing long-term bull market in gold.

Dropping down to the 4-hour timeframe - the breakout above resistance is even clearer and we will only initiate long positions while the 2480 former resistance holds as support.

Like all markets at all-time highs, it is harder to pinpoint price targets to the upside but naturally gold will respect even numbers (2600, 2700 etc).

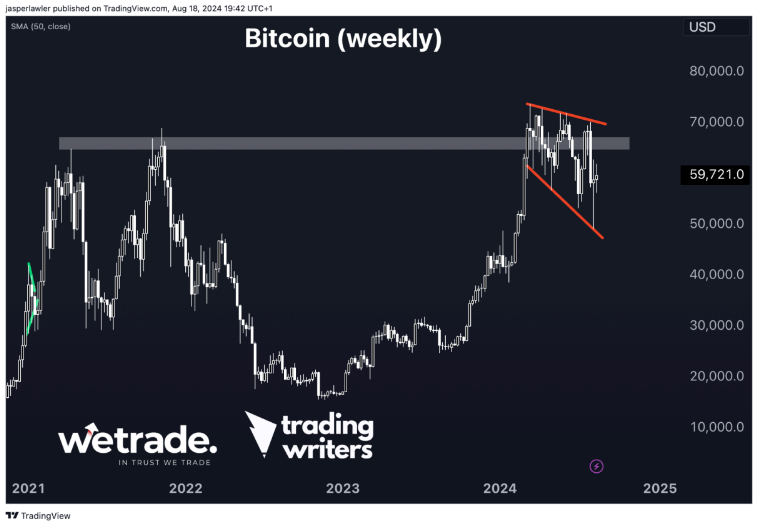

Bitcoin (BTCUSD)

It’s been a volatile couple of weeks in financial markets - and if you like volatility (and by the way, all traders should because it means more price movement with less waiting!) Bitcoin - as always - was one of the first places to look.

The price tumbled $20k from over 70,000 down to below 50,000 but has now formed a nice looking bullish hammer pattern on the weekly chart - right at a down-sloping trendline connecting the recent lows.

Bigger picture, we will only get really interested in Bitcoin if it’s above its prior ATHs from 2021 around 65,000 because for now that resistance has not properly been cleared - the price has struggled every time it got above there since.

On a trading timeframe we think the bullish hammer on the weekly chart is reason enough to look for long positions.

BTC has been trading in a 4k range between 58,000 and 64,000. We think the fakeout below support at 58,000 is a sign the price is ready to break higher from this range. Bullish positions can be taken inside the range for a lower entry point or after a confirmed break above 62,000 targeting 69,000 (i.e. ahead of main resistance at 70,000). However another drop below 58,000 would nullify the idea.

AUD/USD

In the forex market, the Aussie dollar tends to be one of the currencies that benefits when stocks are rising and people are taking risks.

In the heat of the stock market sell-off a fortnight ago, AUD/USD got pummelled. That isn’t surprising. What was more surprising - and we think presents an opportunity - is how quickly it bounced back. Unlike stocks, or Bitcoin, the Aussie recovered in the same week. Part of that is because it had already been selling off the previous two weeks. We think the other part is a strong underlying demand.

The hammer/engulfing pattern off a long-term rising trendline is bullish. Now we have had another bullish week afterwards to confirm it.

The 4-hour chart shows a nice V-bottom with a neckline at just over 0.655 that was successfully re-tested as support last week.

We would be looking for this trend to accelerate while above 0.665. Another steeper pullback would need to stop at or above 0.665 to maintain the bullish bias.

What do you think about our ideas? Do you agree/disagree?

Let us know by leaving a comment or by contacting customer support. Happy Trading!

Trade with WeTrade!

Every position closed is one step closer to unlocking WeTrade Honours privileges and redeeming exclusive rewards.

Start your trading journey here - Register now

Kickstart your trading of the week here - Login Now

Produced by Jasper and the Trading Writers team in collaboration with WeTrade.

As a part of our 9th-anniversary celebration, we're giving away up to 90,000 USD in cashback from 1 to 31 August 2024. New clients will receive 2 USD cashback for every standard lot traded, subject to a maximum of 60,000 USD. Meanwhile, existing clients can earn 2 additional Reward Points per traded lot, capped at 30,000 Reward Points.

Additionally, you can unlock up to 30,000 USD in tiered cash reward packages too! For more information, see here.

Posted on 19 August 2024 at 10:00 AM