Hello guys and welcome.

I’m sure many of you are exclusively trading the major currency pairs.

That’s great because in these bulletins we are definitely going to cover these A LOT.

But.. we also want to bring you opportunities where - perhaps - you wouldn’t usually be looking.

If you don’t trade the forex crosses it’s ok, perfectly ok of course! Some FX crosses are too volatile and some - like EUR/GBP - tend to just move a bit too slowly for many traders.

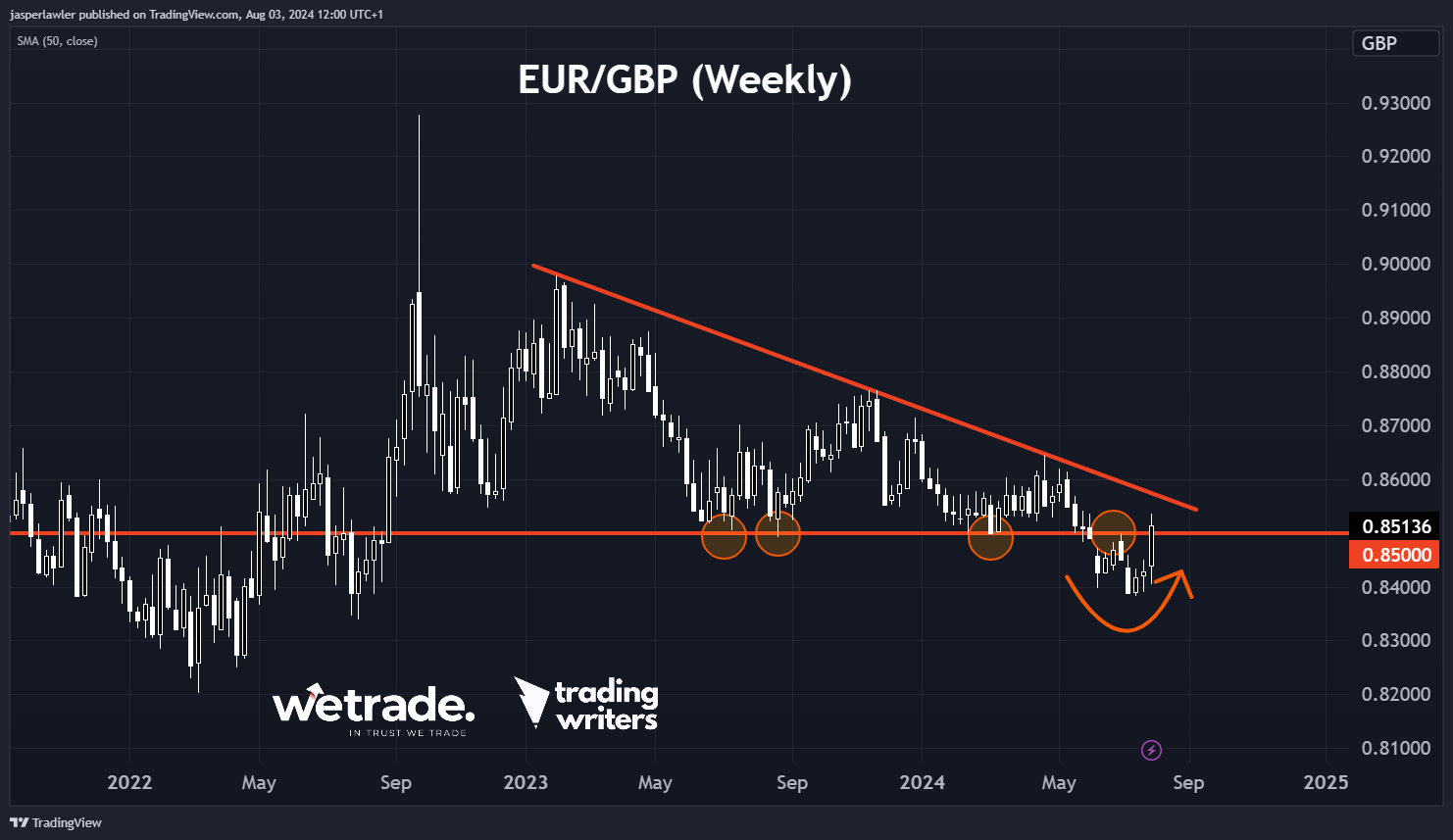

EUR/GBP

This forex cross was not a slow-mover last week!

Euro-Sterling has been a beast - up over 100 pips this week alone.

You just need to look at how long the 0.8500 level has held as support to see the significance of what is happening for this currency pair.

In short, EUR/GBP has rallied up from a double bottom around 0.84 to close the week ABOVE critical support at 0.85.

Remember, a weekly close is the ‘gold standard’ for knowing whether a support or resistance level has broken or held. The 0.8500 level has been resistance so a weekly close above this level would strongly imply the resistance has broken.

If 0.8500 is now a ‘BROKEN resistance’ then this old resistance should turn to support- hence our setup on the ‘trading timeframe’ of the 4 hour chart.

This shorter timeframe chart better shows how powerful this 100-pip weekly move has been relative to the price action over the past month.

When there is a big ‘impulsive’ move like this one, we generally want to buy into it - BUT ideally at a discount i.e. on a pullback.

A pullback to 0.8500 the resistance-turned-potential support would be the first place to look followed by 0.8450.

EUR/JPY

Continuing the theme of trading the euro currency - take a look at EUR/JPY.

This chart is not unique - you’ve probably seen all the JPY pairs falling fast i.e massive gains in the Japanese yen.

I try not to mention the ‘fundamentals’ here but the Bank of Japan actually raised interest rates - this doesn’t happen often and is a big deal.

Still, we don’t need to know about the BOJ to see that this rising channel (that has been in play for over 2 years) has just been decisively BROKEN in the last week.

No signal in technical analysis is 100% but a brake below such a clear up-channel is one of the clearest bearish signals you’re likely to see.

I like bargain hunting as much as the next guy and I can see a BIG temptation to buy the lows in EUR/JPY right now - and actually I think a lot of traders will do just that.

A lot of buyers tends to mean a rise in the price - but we DO NOT buy rallies in downtrends - Instead we anticipate them - and sell into them - because it's a bear market and we think the price ultimately goes lower.

A 500 pip move often takes a long time - but EUR/JPY is one of the forex crosses I mentioned at the start that is usually more volatile than the major pairs. Added to that is the concept in markets that a fast move tends to result in a fast reaction.

A quick rally to 165.0 would provide an opportunity to rejoin the downtrend.

Should the rally off the lows be slower, we will need to’ reassess entry points as the price action develops.

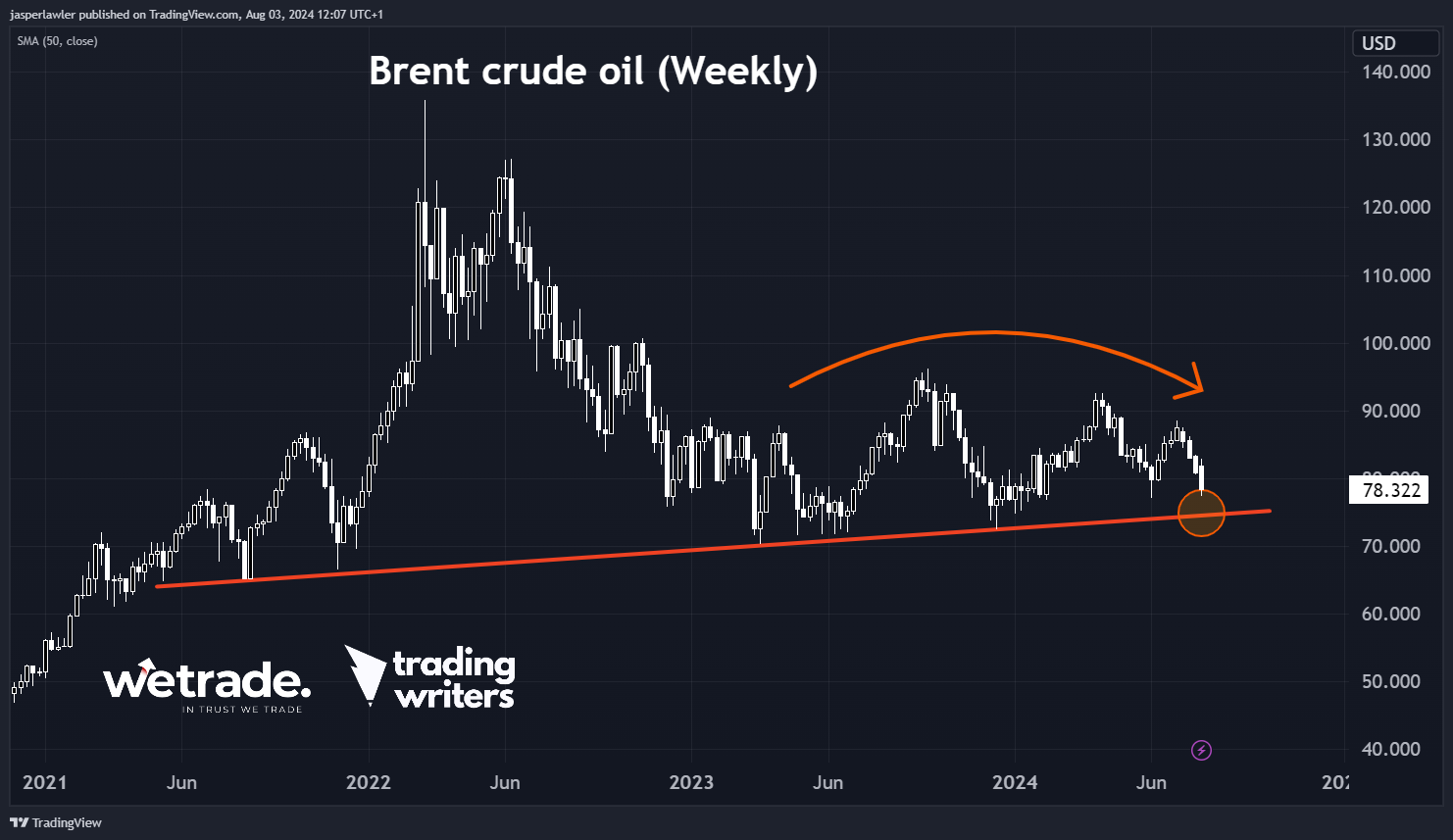

Brent Crude Oil (BCO)

It just kinda looks like oil doesn’t want to go back over $100 right now.

At the last peak in June it couldn’t even get over $90.

On the weekly candle chart, you can see three lower peaks. This signals sellers are getting more aggressive with their bearish positioning.

But the bulls have held onto this rising trendline for over a year. While the price is above this trendline, we are sellers - but we will not chase this market.

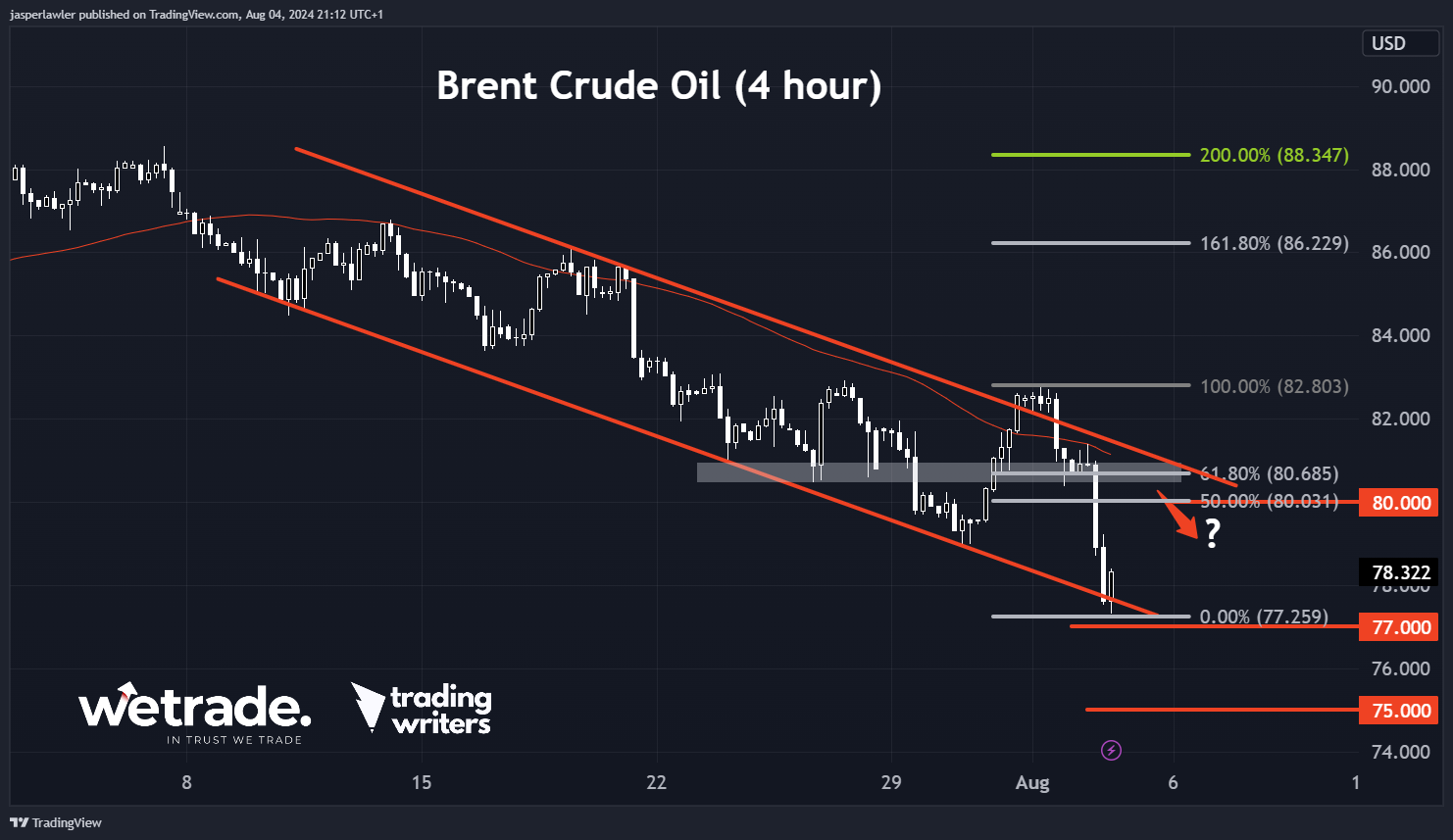

On the trading timeframe, we can see a bearish channel has developed - and the price has just made a bullish reaction off this bottom channel line around $77.

A rally up to $80 would coincide with the 50% retracement of the decline from the August high.

Just above is the 61.8% and former support. The ‘golden pocket’ is a place to look to resume the current downtrend targeting the long term rising support - roughly around $75.

This was your weekly technical analysis - see you next week!

Cheers!

Jasper, Market Analyst for WeTrade and Founder @ Trading Writers.

Trade with WeTrade!

Every position closed is one step closer to unlocking WeTrade Honours privileges and redeeming exclusive rewards.

Start your trading journey here - Register now

Kickstart your trading of the week here - Login Now

As a part of our 9th-anniversary celebration, we're giving away up to 90,000 USD in cashback from 1 to 31 August 2024. New clients will receive 2 USD cashback for every standard lot traded, subject to a maximum of 60,000 USD. Meanwhile, existing clients can earn 2 additional Reward Points per traded lot, capped at 30,000 Reward Points. You can also unlock up to 30,000 USD in tiered cash reward packages! For more information, see here.

Posted on 5 August 2024 at 12:00 PM